Chapter 8: Contingent Capital: Economic Rationale and Design Features in: Building a More Resilient Financial Sector

Credit Suisse watches ~$17billion in Tier 1 Contingent Convertible Capital Instruments (CoCo) bonds become worthless. What are Contingent Convertible Capital Instruments (CoCo) bonds? More details inside. : r/Superstonk

Chapter 8: Contingent Capital: Economic Rationale and Design Features in: Building a More Resilient Financial Sector

Chapter 8: Contingent Capital: Economic Rationale and Design Features in: Building a More Resilient Financial Sector

Chapter 8: Contingent Capital: Economic Rationale and Design Features in: Building a More Resilient Financial Sector

Cost of equity vs. CoCo yield diagram. Note: CoCo refers to Contingent... | Download Scientific Diagram

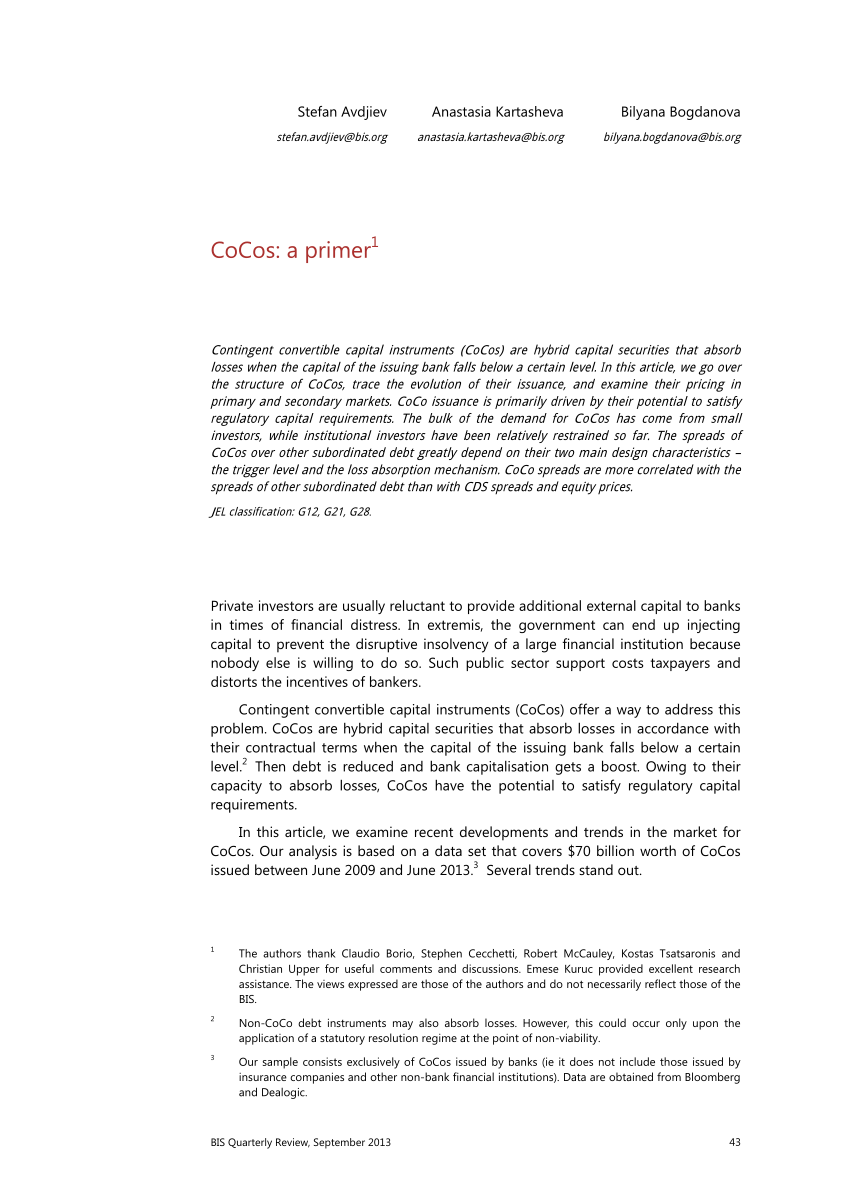

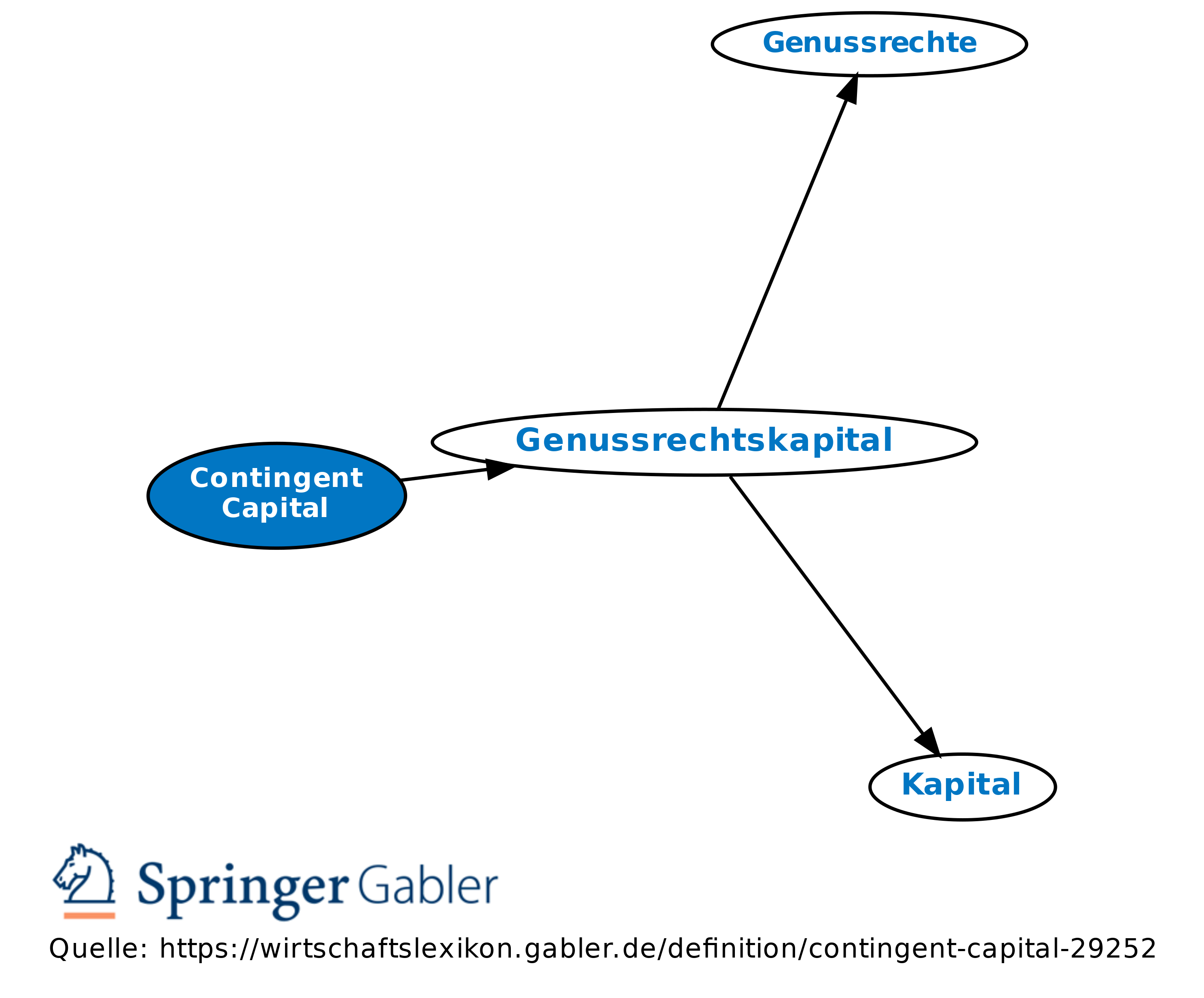

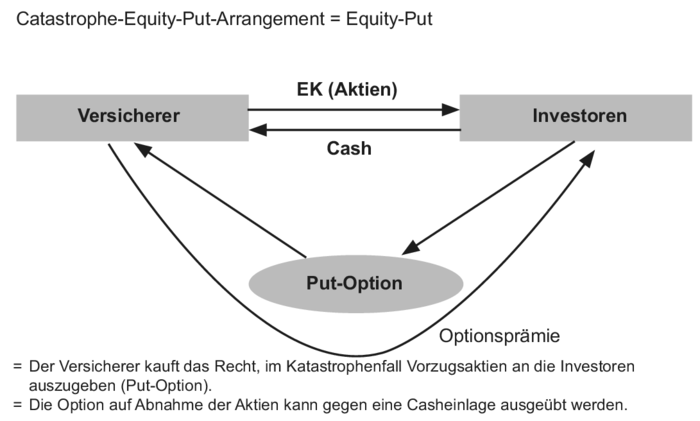

CCN's: What is the rationale behind contingent capital and other hybrid debt instruments? Although "untested" the basics and how they work are covered