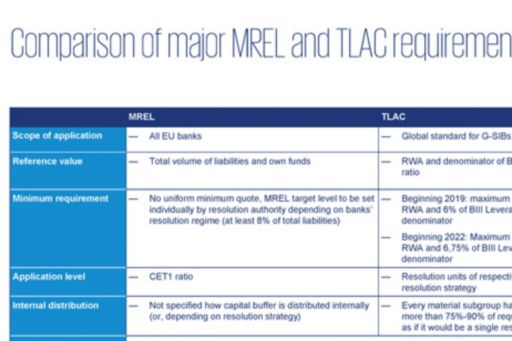

The marketing of MREL securities after BRRD. Interactions between prudential and transparency requirements and the challenges wh

Bail-inable securities and financial contracting: can contracts discipline bankers? | European Journal of Risk Regulation | Cambridge Core

PS30/16 - The minimum requirement for own funds and eligible liabilities ( MREL) - buffers and Threshold Conditions | PS30/16 - The minimum requirement for own funds and eligible liabilities (MREL) - buffers

General approach of the Czech National Bank to setting a minimum requirement for own funds and eligible liabilities (MREL) - Czech National Bank

ThrowbackThursday to our @EU_SRB publication of the minimum requirement for own funds and eligible liabilities (#MREL) dashboard for Q2.2022. Key findings here: https://t.co/w8cHvWu8Pe https://t.co/34gMjSqYrt - EU Agenda

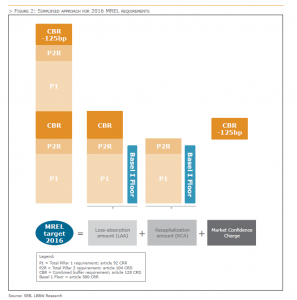

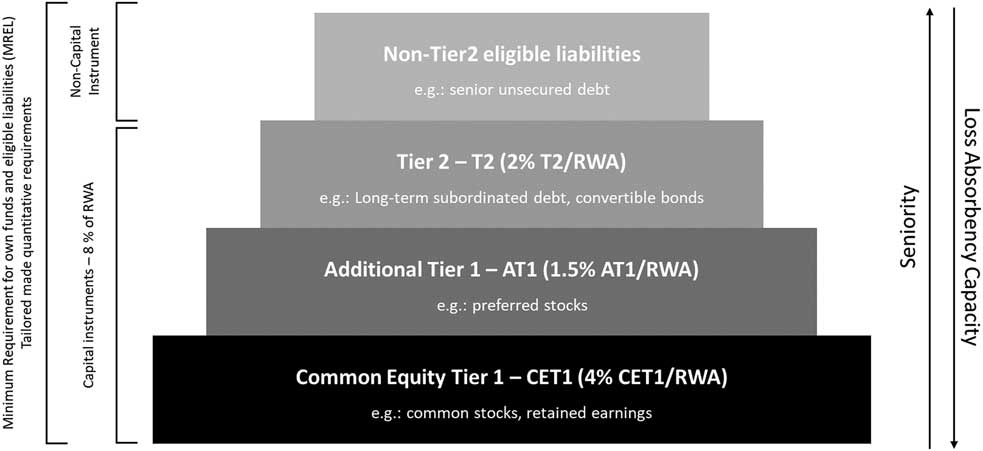

Minimum Requirement for Own Funds and Eligible Liabilities (MREL) 2018 SRB Policy for the first wave of resolution plans

Minimum Requirement for Own Funds and Eligible Liabilities (MREL) SRB Policy for 2017 and Next Steps

Minimum Requirement for Own Funds and Eligible Liabilities (MREL) SRB Policy for 2017 and Next Steps

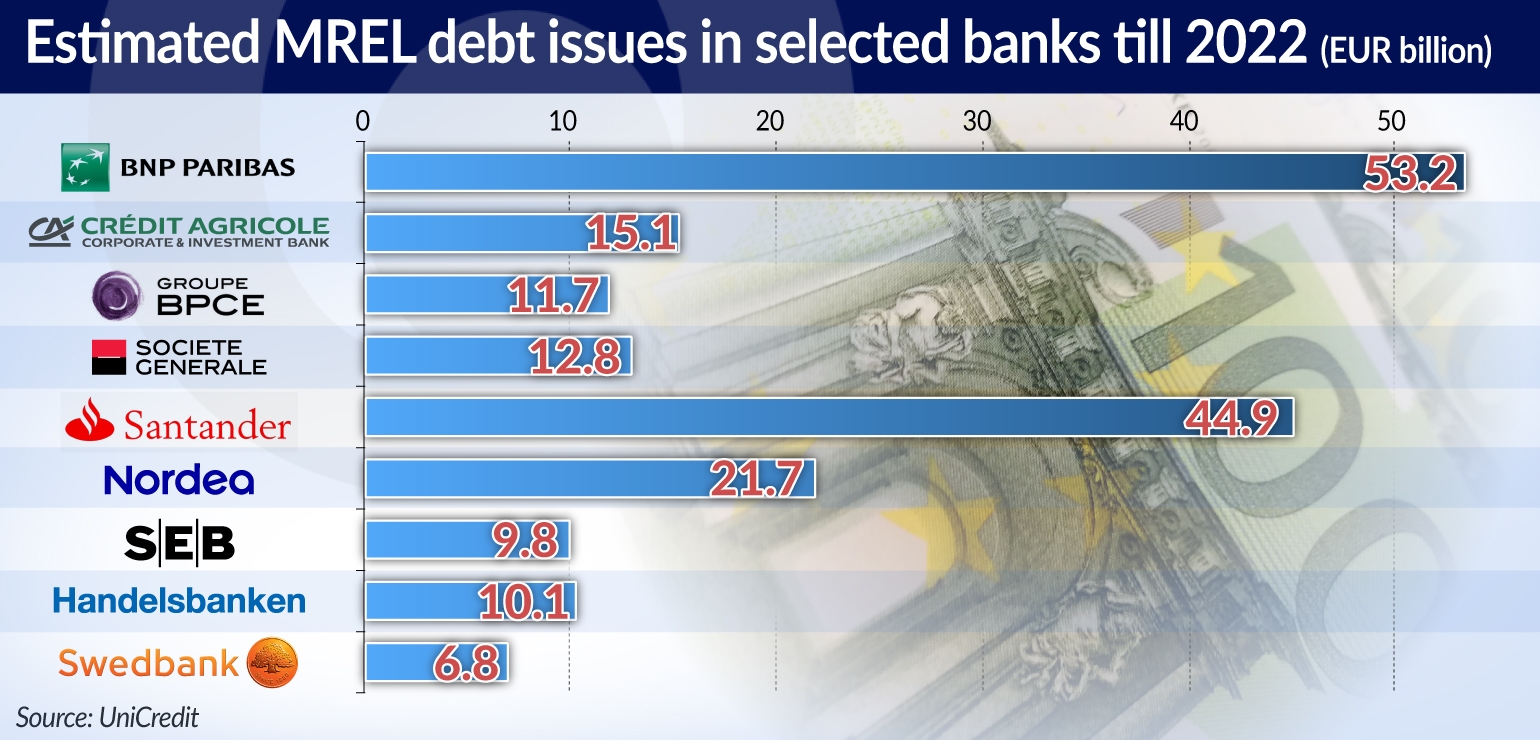

MREL will be a challenge for banks and regulators | Obserwator Finansowy: Ekonomia | Gospodarka | Polska | Świat

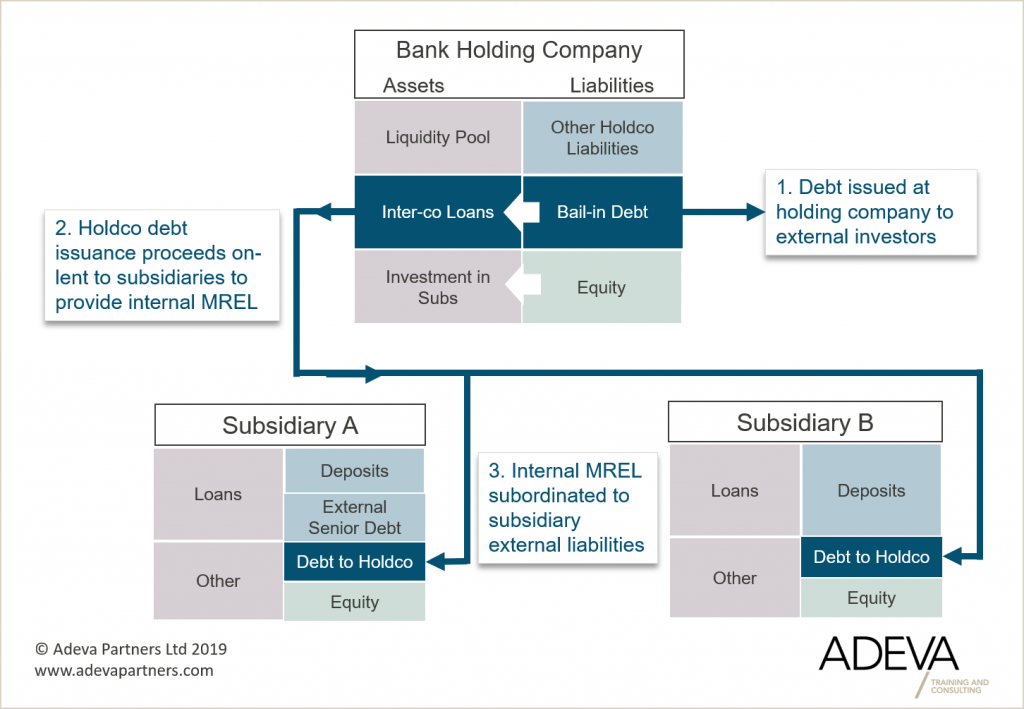

Single Resolution Board recommends UK-style Minimum Resolution Eligible Liability (MREL) requirements - Adeva Partners